La primavera ha llegado y con ella, los habitantes locales de las montañas se están dirigiendo hacia destinos más cálidos, como Cabo, para disfrutar de un descanso. En Aspen, estamos oficialmente en temporada baja, lo que significa que es un buen momento para ponerte al día con las últimas tendencias en el mercado inmobiliario local.

El comienzo de enero de 2024 fue prometedor, con 13 ventas que superaron los 10 millones de dólares. Sin embargo, al profundizar en los datos, hay más información interesante para compartir. Vamos a examinar los detalles con mayor profundidad:

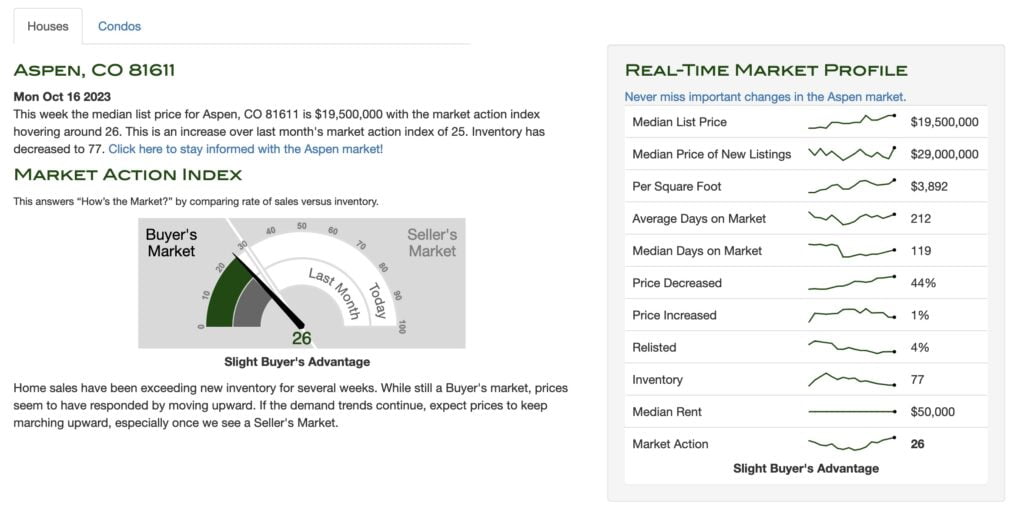

El panorama general se asemeja al que compartimos en nuestra última actualización en noviembre de 2023. El análisis indica que el mercado está ligeramente inclinado a favor de los compradores. El precio medio de lista ha disminuido en $1, 200,000 desde entonces, situándose en $18.2 millones, y el precio por pie cuadrado ha bajado más de $300 a $3,551. Estos cambios reflejan una oferta diferente de propiedades, lo que podría resultar atractivo para quienes buscan comprar. A pesar de esto, las ventas en el primer trimestre de Aspen han experimentado un aumento del 30% en volumen en dólares y un 40% en ventas unitarias en comparación con el mismo período en 2023, y las propiedades se están acercando a sus precios de venta esperados.

¡Clic aquí para más información!