Summer is definitely here - we've passed the solstice and Independence Day and are well on our way through July. It's time for an updated look at the state of the Aspen/Snowmass real estate market!

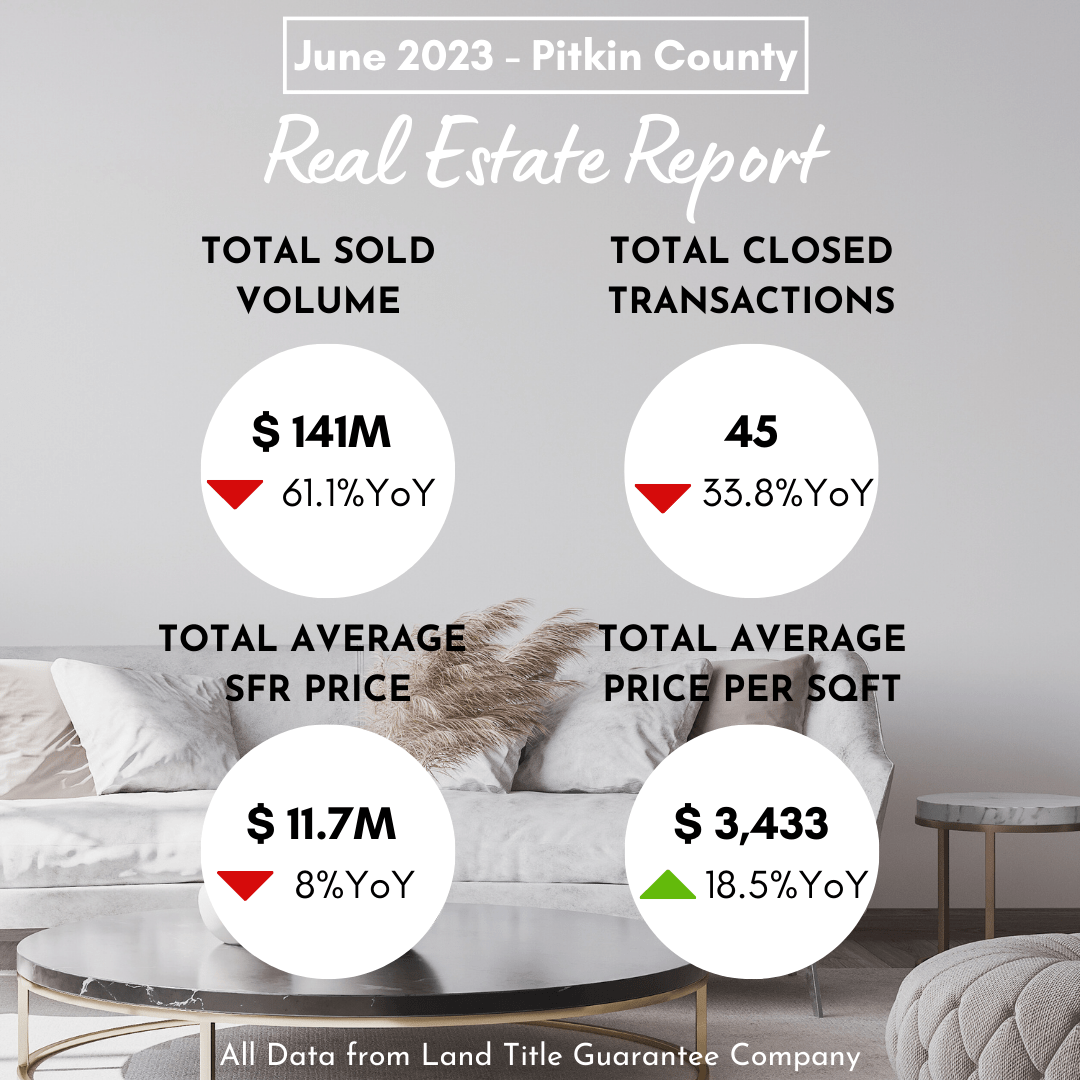

Midway through 2023 we’re seeing that inventory has rebounded a bit from historic lows last year but still remains well off the highs of 2019 and prior. Let's have a look at the most recent snapshot from Land Title Guarantee.

The total sold volume has dropped from this spring and even the month of May. Mortgage rates and recent tax assessments may be taking a toll (read on for more about this below). It's well off the remarkable highs from 2021 and 2022 caused by pent up demand during the pandemic. Closed transactions are also up a bit from the springtime (45 vs 41 in March) but still well below last year's pace.

Market dynamics in Aspen itself remain much the same as in April, still slightly favoring buyers as indicated by the following meter enclosed in Title Company of the Rockies most recent Market Action Index for July 12, 2023.

What’s changed since March is there are more listings now (325 versus 229) which gives buyers more options (though nothing close to the 400-500 mark we saw in 2019). That said, we’re well into what is typically the peak time for sales so those numbers could fluctuate depending on when buyers take action.

Overall inventory is up a bit and prices are holding steady. Let's dig in to our select categories below for a more detailed picture.

Based on the most recent analysis from Title Company of the Rockies, our condominium/ townhome group of properties shows a slight increase in the number of days on the market (145 vs 125 in February) but still roughly the same price per square foot as in the spring at $3,484 vs $3,489. Things are relatively stable in this segment including the median price which now stands at $3.85 million. Have a look at current inventory here!

This group consists of older, majority free-standing homes that are further away from central cores and/or could be in need of sprucing up. The makeup of this category has changed as the median price has increased but the square footage has dropped since April ($6,995,000 and 3,047 sq. ft vs $6,400,000 and 3,200 sq. ft). Still, there’s room to maneuver for buyers as the number of days on the market for this category has gone up from 182 to 259. View these listings here!

Once again, the lion’s share of homes for sale are in this category. Things remain in flux here as the median price has dropped just a bit to $13,600,000 vs $14,100,000 in the spring. Buyers should note that Colorado counties including Pitkin recently revised their property tax assessments and most have jumped dramatically (in some cases doubling). This could cause sellers to reassess whether they want to hold on to properties with greater annual expenses or put them on the market and cash out. Here’s the current inventory of homes in this group!

According to our friends Bill and Lori Small, we’ve seen some recent blockbuster sales in this category including a ski-in, ski-out Aspen Mountain home for a record $65 million. The month of May saw five high-end transactions in worth $174.6 million which have boosted the total sold volume from the spring. They’ve also upped the total percentage of sales in this category from 27% to 31%. That said, the good news for buyers according to Title Company of the Rockies is that the increased inventory has dropped the median price to $33 million (vs. $36 million in April) and the age of the median home is now 17 vs 20 years. Have a look at the listings in this price range here!

Rental Properties

If you're interested in relocating to Aspen be sure to have a look at the wide selection of rental properties on the market right now. This is a perfect option for those who may need to move here before purchasing or anyone who may just want to spend a season out here. Be forewarned, many who join us for a season wind up never leaving!

Looking Ahead

There are several key factors impacting both buyers and sellers in the current market and going forward.

On the seller's side, mortgage interest rates have gone up which is acting as a damper on market activity. Sellers who locked in lower mortgage rates may be reluctant to let their properties go and take on new mortgages and buyers may reassess their budgets to find better options.

Second, the stock market is bouncing back strongly after being mired in a plateau for the past year or so. This gives potential buyers reassurance and stability and more assets to invest in real estate.

Third, the large jump in property tax valuations out here will affect both buyers and sellers. It could cause more properties to come to market but buyers should be careful in evaluating the total cost of ownership before putting in an offer.

Lastly, the one thing that remains true above all else is the enduring appeal of real estate in Aspen, Snowmass Village, and the greater Roaring Fork Valley. This has remained true throughout recessions, pandemics and other periods of economic and societal insecurity. The market remains strong.